2022: A year of M&As, Consumer-centric Digital Initiatives and More

Yet another year is over. And what a year it has been for the healthcare industry. Big ticket mergers and acquisitions, non-traditional players are entering traditional healthcare (through acquisition, of course!), cyber security threats and data breaches, and more industry-shaping events.

Every year, at year-end, we try to dig down our archives and tell you what buzzed during the year. In this post, we have gathered landmark events that shaped the healthcare industry in 2022 and some of the trends highlighted by leading healthcare leaders in our healthcare digital transformation podcast, The Big Unlock.

Healthcare industry-shaping events

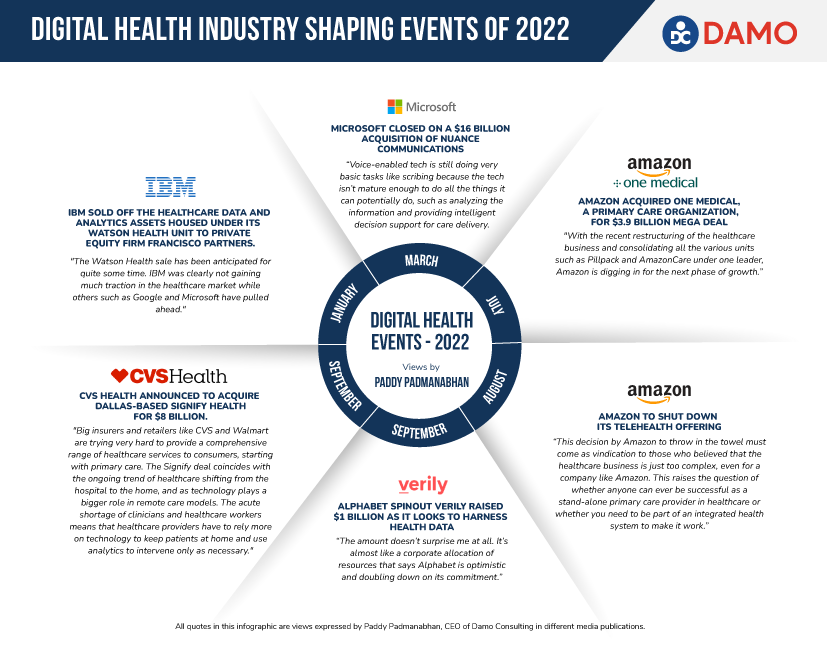

The year started with a big bang, with IBM selling off its healthcare data and analytics assets housed under its Watson Health unit to private equity firm Francisco Partners. This was an event waiting to happen as IBM was not gaining much traction in the healthcare market with Watson Health.

To seize a $500 billion market opportunity, Microsoft acquired Nuance Communications. The plan was to package its cloud computing with Nuance’s software products to deliver AI tools more seamlessly to providers and payers. While the tech isn’t mature enough to do all the things it can potentially do, it is a promising step.

Another disrupting event was the purchase of One Medical, a primary care organization offering its members in-person and 24/7 virtual care, by Amazon, an eCommerce behemoth, for $3.9 billion. In the words of Paddy Padmanabhan, an industry thought leader and CEO of Damo Consulting, “Amazon is clearly no longer a company providing tech solutions to healthcare. It is now undeniably in the healthcare business. You have one of the largest companies on the planet with one of the deepest pockets on the planet getting into one of the largest sectors in the US economy.”

Following this acquisition, Amazon announced shutting down its telehealth service for its employees by year-end. Thus, leaving an important question – whether anyone can ever be successful as a stand-alone primary care provider in healthcare or whether you need to be part of an integrated health system to make it work.

In September, CVS Health announced its plan to acquire Signify Health, and its network of doctors caring for patients at home, in an $8 billion deal. While the Department of Justice has requested more information about the deal, and CVS expects the deal to close in the first half of 2023, the deal is a significant milestone and implies the growing demand for home health.

Finally, the latest in the series is the Alphabet’s spin-off Verily. Verily raised $1 billion in a funding round led by Alphabet. According to Paddy, “The amount is not a surprise at all. It’s almost like a corporate allocation of resources that says Alphabet is optimistic and doubling down on its commitment.”

What healthcare leaders spoke about digital health and digital transformation in 2022

Digital health funding

In 2022, digital health funding slowed down compared to the previous year. However, this slowdown resulted from thoughtful spending in later-stage startup companies. According to Jacob Effron, Principal, Redpoint Ventures, the macro trends driving the growth of digital health funding are still in place. While the early-stage companies continued to receive interest from investors, the later-stage companies have been uncertain. While the sales cycle in the healthcare industry continues to be the biggest challenge for CEOs and Founders, digital health startups must find ways to sail through to the greener times. According to Matthew Warrens, Managing Director, UnityPoint Health Ventures, “to survive in the healthcare industry, digital health startups must pick a lane and stay with it.”

Patient access and user experience are the winners

Health systems, some of whose healthcare leaders were our esteemed guests on our digital transformation podcast, The Big Unlock, were unanimous about the need to focus on patient access, patient engagement, and consumerism. For Ashish Barad, MD, Clinical Lead, Digital Health, Baylor Scott & White Health, their mission with digital health is to provide guidance and choice to consumers in an easy, frictionless way. For Sara Vaezy, Chief Digital Officer, Providence, their priority is to build a consumer identity and engagement platform as the cornerstone of their digital strategy.

Digital health startups providing technology and innovation to the digital transformation ecosystem for healthcare seem to be in sync with this requirement. According to Russ Thomas, Chief Executive Officer, Availity, “digital health is about smartly applying data into interactive user experiences”. To enable this application, the company is engaged in optimizing information exchange between two of the most critical stakeholders in the healthcare ecosystem – health plans and providers – through a single, secure network. Another startup, Notable, is building an intelligent automation platform that seeks to transform how patients access to care. According to Pranay Kapadia, CEO and Co-founder, “automation is about marrying patient experience that is ADA compliant, in any language, and that works on any device for any human on the planet, with the best workflow integration.”

Understanding of digital in health is evolving

More health systems are evolving with their understanding of what is digital in healthcare and the meaning of digital transformation. They are also evolving with their piecemeal attitude toward developing point solutions that are more IT-driven and not driven by their business needs. Healthcare leaders are now putting in effort and funds to identify the problem and define it well before applying a trending ‘hot’ technology in the market. According to Tim Skeen, SVP & CIO, Sentara Healthcare, “It is important to define what the problem is, what good looks like, what is the outcome one wants to achieve, and what the value is; and then prioritize those things that bring the highest value to approach in a structured way.”

Another route of evolution in healthcare is the M&A route. According to Zane Burke, Chief Executive Officer, Board Member, Quantum Health, “the big value is always in the cases that are the most expensive and in the top 1% driving 50% of costs.” To put that together requires the digital pieces, along with the personal touch pieces. That is why there will be more M&A activity for those with deep pockets on a go-forward basis.

The Potential and Opportunities

And lastly but not in the least, the healthcare industry still has immense potential for digitalization. Julia Hu, CEO and Co-founder of Lark Health, says, “healthcare is the last industry that hasn’t yet been truly revolutionized and disrupted by technology.” While the demand for doctors and nurses is high in the country, there aren’t enough to care for people with chronic conditions without getting overworked. By automating and digitalizing different processes in healthcare, both non-clinical and clinical, human involvement can be focused on more value addition and life-saving events.

The impact of digitalizing healthcare is patient access and care delivery. Before COVID, patients and caregivers were reluctant to adopt technology for patient care delivery and outpatient consultation. With COVID having removed that barrier and proven its worth in real-life scenarios, people are more willing and open to technology adoption in healthcare, including the rural area population. This has opened new possibilities and avenues for delivering quality care to far-off areas and into the hinterland of the States. As Jared Antczak rightly mentions in his conversation with Paddy Padmanabhan that technology integration is one of the greatest opportunities that we have in healthcare today. The goal is to provide a cohesive and seamless experience, remove friction, and engage patients in a meaningful way.

Listen: Top 10 most listened episodes of 2022 – The Big Unlock podcast