The WITCH Report:

2020 Mid-Year Review

A review of the financial and market performance of global IT consulting firms in healthcare

*Get free 1-year subscription of the WITCH Monthly Monitor with every purchase of The WITCH Report – Annual Review.

*Get free 1-year subscription of the WITCH Monthly Monitor with every purchase of The WITCH Report.

This mid-year review report covers the financial and market performance of 13 major global technology consulting firms, specifically in the healthcare segment. Companies covered in the report are Wipro, Infosys, TCS, Cognizant Technology Solutions, HCL, Accenture, Atos, Deloitte, DXC Technology, IBM, NTT Data, Optum, and Tech Mahindra.

Takeaways

- The initial slowdown due to COVID-19 has given way to new demand for IT services, largely with a focus on cost reduction.

- The WITCH group of companies grew their healthcare and life sciences revenue by 4.84% during 2020 compared to the same period in 2019.

- Relative to overall company growth, most of the firms have done well in their healthcare segment, which is an indication of the continued attractiveness of healthcare markets for the firms.

- Demand for telehealth and other patient-facing initiatives increased in 2020, leading to demand for CRM and data management infrastructure solutions.

- Increase in infrastructure support outsourcing among providers, BPO transactions among payers, and new technology initiatives around cloud migration as key opportunity areas.

Performance highlights

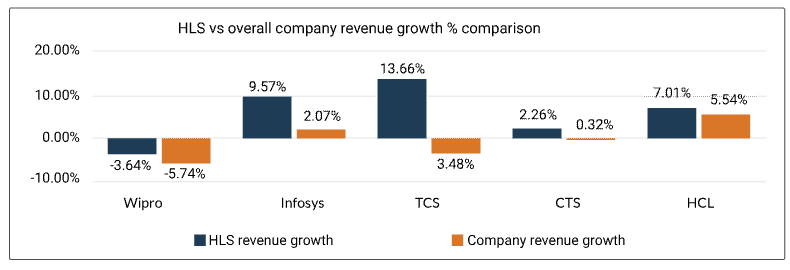

- The WITCH group of companies collectively grew their HLS revenues by $226 million, from $4.67 billion to $4.90 billion or by 4.84% during the six months in 2020 compared to the same period in 2019. The overall HLS operating margins (OM) for the three companies that reported segment-wise OM’s (Wipro, Infosys, CTS) was 24.69%, compared to 25.03% for the same period in 2019.

- During this period, except for Wipro, the HLS sector growth outperformed overall company revenue growth, indicating strong demand in the healthcare IT markets relative to the overall market conditions in the post-COVID-19 scenario.

- Among the WITCH group, the HLS segment had single-digit growth for Infosys and HCL, while TCS recorded double-digit growth. TCS and HCL’s healthcare business was the most resilient among the other verticals amid the crisis. The companies expect increasing demand for their healthcare solutions and services from payers, providers, pharma, and life science companies to combat the COVID-19.

- All companies responded proactively to the COVID-19 by providing critical services forhealthcare companies.

- Wipro enabled virtualization and automation of clinical trials for their clients.

- Infosys developed a contact tracing app for the State of Rhode Island.

- Scientists from TCS Innovation Labs identified 31 potential molecules that could target the proteins on the coronavirus.

- Cognizant helped a life sciences supplier fast-track COVID-19 diagnostic kits, expedite COVID-19 clinical trials, and develop an online test booking facility for a retail pharma chain.

- HCL supported virtual clinical trials for their clients.

The WITCH Monthly Monitor

*Get free 1-year subscription of the WITCH Monthly Monitor with every purchase of The WITCH Report.

The WITCH Monthly Monitor is a monthly update on major global IT consulting and services firms in healthcare. It provides latest financial and market performance updates on WITCH companies along with other global IT consulting firms.

- The current crisis has boosted the demand for digital technologies, mainly around cloud adoption and virtual workplace. Wipro, Infosys, and TCS partnered with IBM for IBM public cloud to accelerate their clients’ digital transformation. They also launched many solutions around the virtual workplace.

The WITCH Report: 2020 Mid-Year Review (single copy: $195)

The WITCH Report: 2020 Mid-Year Review + three years of data on client wins, partnerships and M&A (bundle price: $295)

*Get free 1-year subscription of the WITCH Monthly Monitor with every purchase of The WITCH Report.

For any queries or assistance, please write to marketing@damoconsulting.net

- The WITCH group: 2020 mid-year performance and outlook

- Wipro

- Infosys

- Tata Consultancy Services

- Cognizant

- HCL

- Accenture

- Atos

- Deloitte

- DXC Technology

- IBM

- NTT Data

- Optum

- Tech mahindra

Figures

- Figure 1: Revenue and operating margin for overall company and HLS for the WITCH group

- Figure 2: Revenue growth over the last four quarters, Wipro

- Figure 3: Revenue growth over the last four quarters, Infosys

- Figure 4: Revenue growth over the last four quarters, TCS

- Figure 5: Revenue growth over the last four quarters, Cognizant

- Figure 6: Revenue growth over the last four quarters, HCL

Tables

- Table 1: Revenue and operating margin for overall company and HLS for the WITCH group

- Table 2: Revenue and operating margin for overall company and HLS, Wipro

- Table 3: Innovation centers since 2016, Wipro

- Table 4: Revenue and operating margin for overall company and HLS, Infosys

- Table 5: Innovation centers since 2016, Infosys

- Table 6: Revenue and operating margin for overall company and HLS, TCS

- Table 7: Innovation centers since 2016, TCS

- Table 8: Revenue and operating margin for overall company and HLS, Cognizant

- Table 9: Innovation centers since 2016, Cognizant

- Table 10: Revenue and operating margin for overall company and HLS, HCL

- Table 11: Innovation centers since 2016, HCL

- Table 12: Company and H&PS revenue, Accenture

- Table 13: Company and public & health revenue, Atos

- Table 14: Company and segment revenue, Optum